As you navigate the complex world of financial services, you’re likely no stranger to the challenges of standing out in a crowded market. Your customers are bombarded with offers, advice, and information from every direction. How can you possibly establish your brand as a trusted authority via content marketing for financial services?

What if you could flip the script and start attracting customers who are genuinely interested in what you have to say?

That’s where content marketing comes in. It is a powerful strategy for building relationships, establishing credibility, and driving business results in this sector.

The Importance of Content Marketing in Financial Services

For financial institutions, content marketing is no longer a nice-to-have. You absolutely MUST have this strategy to reach and engage with potential clients.

In an industry built on trust and credibility, content marketing provides a platform to showcase expertise, build relationships, and ultimately drive business growth.

Building Trust with Potential Clients

Fiduciary responsibility is at the heart of financial services, so customer trust is of utmost importance.

By creating informative and helpful content, you demonstrate your understanding of their needs and concerns, establishing your brand as a trusted authority in the industry.

Staying Ahead of the Competition

One key differentiator in the financial services industry is the ability to provide valuable insights and expertise through content marketing.

By doing so, you set your brand apart from competitors and position yourself as a thought leader in the market.

This competitive advantage is especially important in the financial services industry, where products and services can be complex and nuanced.

By creating high-quality, informative content, you educate and empower your audience.

An educated and empowered reader will be more likely to choose your brand when they’re ready to make a financial decision.

You’ll not only attract new customers but also retain existing ones, as they come to rely on your expertise and guidance.

Identifying Your Target Audience

Now that you’re ready to look into content marketing for your financial services, it’s time to get to know your target audience.

By understanding who they are, what they need, and what drives them, you’ll be able to create content that resonates and converts.

Specifically, you will generate content that speaks to their unique needs, interests, and pain points.

This will, in turn, increase your chances of attracting and engaging with them.

Demographics and Psychographics

On the surface, demographics like age, income, occupation, and education level can give you a general idea of who your audience is.

But to really get inside their heads, you need to dig deeper into psychographics – their values, attitudes, interests, and lifestyles.

- What motivates them?

- What keeps them up at night?

- What do they care about?

Pain Points and Goals

For your content to truly connect with your audience, you need to understand their pain points – the challenges, frustrations, and problems they face.

- What are their goals, aspirations, and desires?

- What do they hope to achieve by working with a financial services provider like you?

This is also a key step in generating content that speaks directly to their needs.

You can develop targeted solutions, offer valuable advice, and provide reassurance that you’re there to help them achieve their financial objectives.

By doing so, you’ll build trust, establish your authority, and ultimately drive conversions.

Crafting Compelling Content

Compelling content is the key to unlocking the hearts and minds of your financial services audience.

It’s about creating a connection that resonates, educates, and entertains.

Your content should be the go-to resource for your audience.

To accomplish this, focus on providing them with valuable insights, expert advice, and a fresh perspective on the financial world.

The Role of Storytelling

For financial services, storytelling is more than just a marketing tactic.

It’s a way to humanize your brand, create empathy, and make complex financial concepts more relatable.

By sharing real-life examples, customer testimonials, or even your own experiences, you can build trust and credibility with your audience.

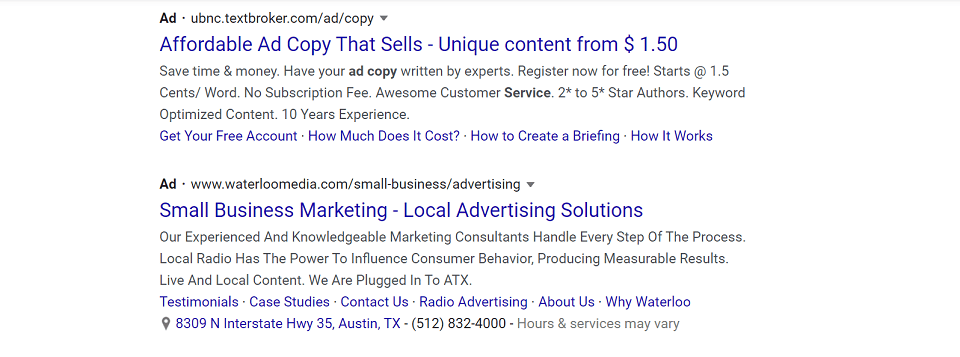

Creating Engaging Headlines and CTAs

To capture your audience’s attention, you need headlines that pop and CTAs that prompt action.

It’s about crafting a clear, concise, and compelling message that resonates with your audience’s needs and interests.

This is where the art of persuasion comes into play.

You want to create headlines that ask questions, make statements, or create a sense of urgency.

And when it comes to CTAs, you want to use action-oriented language that tells your audience exactly what to do next.

By doing so, you’ll increase the chances of converting your audience into loyal customers.

Content Distribution Channels

After crafting high-quality content, you will need to share it with your target audience.

In order to reach potential customers and drive engagement, I recommend you adopt a range of distribution channels.

Content distribution channels will help you greatly amplify your message and increase brand visibility.

Social Media and Email Marketing

To expand your reach, start with social media platforms and email marketing campaigns.

Share your content on Facebook, Twitter/X, LinkedIn, and other platforms where your target audience is active.

You can also create email newsletters to send your content directly to subscribers, encouraging them to engage with your brand.

Blogging and Guest Posting

On your website, create a blog to publish regular articles, providing valuable insights and information to your audience.

You can also write guest posts for other reputable websites in the financial services industry. These links will help you build backlinks to your website and increase your authority.

Guest blogging is an excellent way to establish yourself as a thought leader in the financial services industry.

By writing informative and engaging articles for other websites, you can attract new audiences and drive traffic to your website.

You can also build relationships with other influencers and bloggers in your niche, potentially leading to new business opportunities.

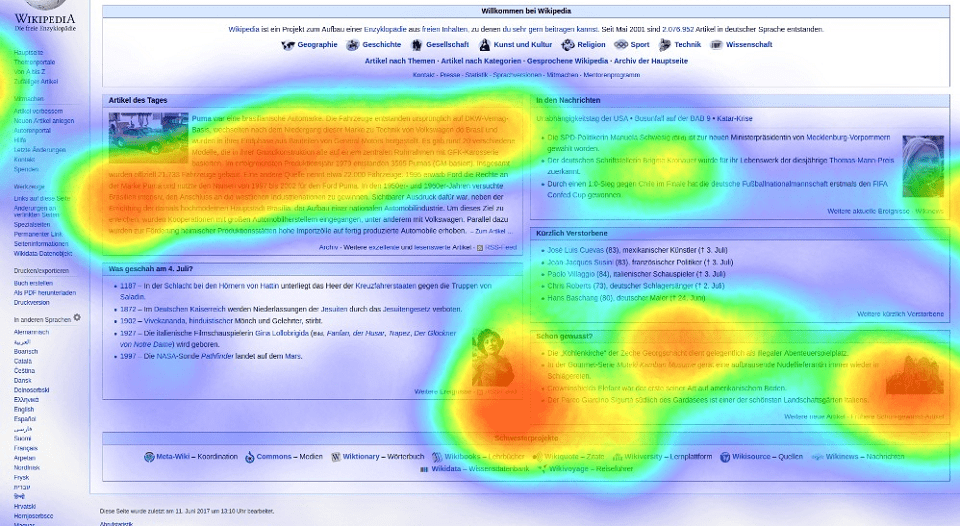

Measuring Success and ROI

Many financial services companies struggle to quantify their returns on their content marketing investments.

You need to move beyond simply tracking website traffic or social media engagement.

Focus on metrics that truly matter, such as lead generation, conversion rates, and ultimately, revenue growth.

Setting Key Performance Indicators (KPIs)

The foundation of any successful content marketing strategy is establishing clear KPIs that align with your business objectives.

You should identify specific metrics that indicate progress toward your goals.

Think of metrics such as the number of leads generated, customer acquisition costs, or increase in brand awareness.

Analyzing and Optimizing Results

Any effective content marketing strategy involves continuous analysis and optimization.

You need to regularly review your performance data to identify areas of improvement, refine your targeting, and adjust your messaging to better resonate with your audience.

Indicators such as bounce rates, time on site, and pages per session can provide valuable insights into how users interact with your content.

By digging deeper into these metrics, you can pinpoint opportunities to enhance the user experience, streamline your content, and drive more conversions.

The goal is to create a feedback loop that informs your content strategy and helps you achieve your business objectives.

Overcoming Common Challenges

To create a successful content marketing strategy for your financial services organization, you’ll need to overcome several common challenges that can hinder your progress.

Regulatory Compliance and Risk Management

Challenges related to regulatory compliance and risk management can be daunting, especially in the financial services industry where regulations are constantly evolving.

You must ensure that your content meets strict guidelines and avoids potential legal pitfalls, all while maintaining a consistent tone and brand voice.

Scaling Content Production and Consistency

Content production can be a significant hurdle, particularly when trying to maintain consistency across multiple channels and audiences.

You may struggle to produce high-quality content at scale, which can lead to a disjointed brand experience and dilute your message.

The key to scaling content production is to develop a clear content strategy that outlines your goals, target audience, and messaging.

This will enable you to create a content framework that can be replicated across different channels and formats, ensuring consistency and efficiency.

By doing so, you’ll be able to produce high-quality content at scale, without sacrificing your brand’s integrity or voice.

Conclusion: Content Marketing for Financial Services

Following this journey into the world of content marketing for financial services, you now possess a deeper understanding of how to craft a strategy that resonates with your audience.

You’ve seen how storytelling, empathy, and relevance can help you build trust and credibility with potential customers.

As you move forward, remember that your goal is not to simply push products, but to educate, inform, and inspire.

By doing so, you’ll create a loyal following that will drive growth and success for your financial services business.

Tommy Landry

Latest posts by Tommy Landry (see all)

- Where AI Introduces Risk Into Revenue Planning - February 19, 2026

- AI Is Already Influencing Your Forecasting. Do You Know Where? - February 18, 2026

- AI -Driven Discoverability Presentation at AIMA (January 2026, Full Video) - February 17, 2026