All businesses need to know how much profit is generated from purchases. The most important and fundamental financial goal of any company is for revenue to exceed outlays, or expenses.

This annual goal stands whether you’re a founder running a startup or the CFO of a national behemoth corporation.

So, how can you predict the expected profit margin with your average customer?

Customer Lifetime Value (CLV) helps you do just that.

This metric is based on financial projections in order to best describe the expected profit margin your company will earn throughout the entire business relationship with the customer.

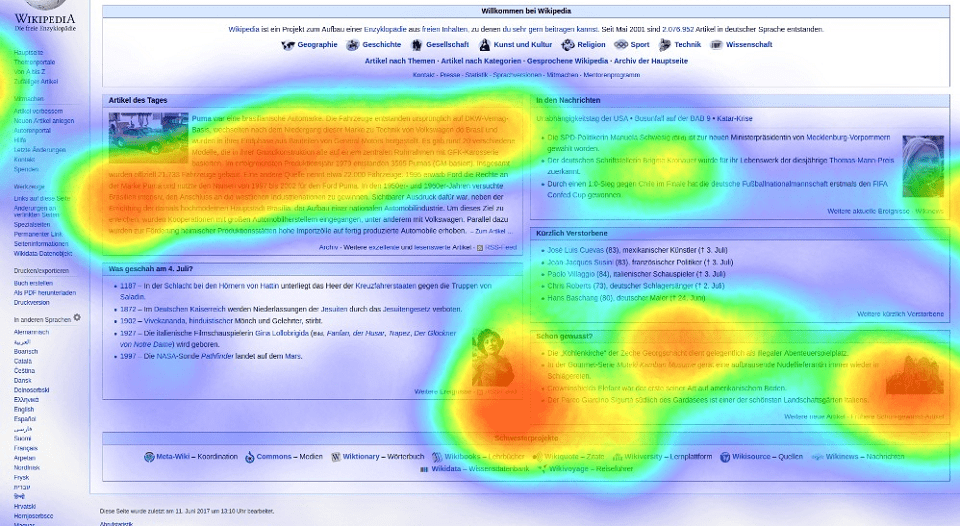

Jump to the infographic from CleverTap below for a visual explanation of this key concept.

Why is Customer Lifetime Value Important?

Customer Lifetime Value is a valuable measurement, because it predicts the long-term profit expected from an individual customer.

Using CLV, businesses can optimize for long-term growth by planning and implementing methods to retain customers.

Customer acquisition costs are included the CLV.

The cost of getting a new customer is higher than the cost of keeping a current one.

This is another reason why it is essential to cater to your current customers, ensuring their brand loyalty.

You can enhance your overall profitability by increasing customer retention rates.

To be precise, as little as a 5% increase in retention rate can yield a 25%-95% increase in profits.

Companies have to take on very little extra work to make this happen, and they should expect significant rewards in return.

How Do You Calculate the CLV?

Calculating Customer Lifetime Value isn’t as complicated as it seems.

Before you can find the CLV, you have to solve for the Lifetime Value (LTV).

The LTV is the average value of sale × number of transactions × retention time period.

After you have determined the Lifetime Value, you can multiply that by your profit margin to compute the Customer Lifetime Value.

Remember that the profit margin reflects the profitability ratio after necessary production expenses, such as manufacturing and operating costs.

The profit margin is the quotient of net income and revenue.

See the equations below for the full break down:

- Customer Lifetime Value (CLV) = Lifetime Value (LTV) × Profit Margin

- Lifetime Value (LTV) = Avg $ value of sale × # of transactions × retention time period

- Profit Margin = Net Profits / Sales

Customer Lifetime Value: Contributing Factors

Churn Rate

This is the rate of attrition, or how often customers cease patronage with a business.

This is calculated by (end # customers – beginning # customers) / beginning # customers.

The churn rate negatively affects the CLV by decreasing the retention time period.

Customer Loyalty

Decrease the churn rate by promoting brand loyalty.

If customers are brand-agnostic or have no preference for a particular brand, they will often jump brands.

This makes CLV difficult to predict. Increase customer loyalty to have a higher and more accurate Customer Lifetime Value.

Sales and Marketing

Be sure to track revenue in response to sales and marketing expenses. In an ideal situation, the two areas are optimized to have a direct, positive relationship (i.e. more sales dollars = more income).

Sales and marketing expenses will affect your profit margin, so it’s crucial that these expenses don’t exceed revenue.

4 Best Practices to Increase CLV

Be Attentive

A single interaction with a customer can make or break your company.

Make all impressions, especially the first, positive.

Remember that the consumer should feel your dedication to their needs.

They should enjoy every touch-point with your company, whether it be in person or online.

Be Open

As they say, communication is key.

Listen to your customers’ grievances and work quickly to resolve them.

Be truthful about the goings-on in the company.

Customers respond positively to open communication with a brand, even if it’s as simple as an acknowledgment.

Be Rewarding

Increase brand loyalty, therefore decreasing churn rates, by offering a rewards program.

Customers will strive to achieve discounts and other rewards through repeat purchases.

Rewarding your customers will prompt them to engage further out of excitement.

Be {Re}Engaging

As mentioned earlier, it is cheaper to retain current customers than acquire new ones.

While customer acquisition is conducive to the growth of your business, you should also dedicate considerable resources to retargeting and re-engaging with previous customers.

Offer a simple, unobtrusive reminder that your brand is there to satisfy their needs.

5 Customer Lifetime Value Statistics

- Just a 5% increase in retention rates yields at least a 25% profit increase.

- New customers cost between 5 and 25 times more than existing customers.

- You have a 60%-70% chance of converting an existing customer.

- Current customers spend on average about two-thirds more than new customers.

- Customer Lifetime Value is an important financial concept for 76% of companies.

CleverTap provides a comprehensive explanation and breaks down of Customer Lifetime Value.

They have created the infographic below to help you understand exactly what it is and how it can help your business.

Latest posts by Kevin Karnes (see all)

- How to Calculate and Optimize Customer Lifetime Value [INFOGRAPHIC] - November 6, 2018